A lesson for MAGA in electricity economics

After a long hiatus, Complex Effects is back to give MAGA a lesson in economics.

Hello, CE subscriber. It’s been a while since my last post. Over six months actually. I’ve been hard at work on my Master’s degree in energy and climate economics here in Barcelona. After submitting our thesis and finishing my final exam last week, I’m going to be enjoying Europe for a while. I’ll be back in New Mexico in August to start my new position as an Economist for the NM Economic Development Department, which I’m very excited about.

Unfortunately, it seems as though I’m coming back to a very different US than the one I left in August. Trump has instigated a full-blown attack on democracy, science, and the reputation of my country. I admit that it’s embarrassing being an American in Europe these days, which was not the case just 10 months ago. In fact, I was quite proud and bullish on our prospects as a country. Of course it’s not too late to recover, but we have 3.5 more years of Trump yet to bear.

I don’t typically get political on this blog, but I will always bring my professional expertise to fight for the things that make people’s lives better. Things like clean energy and transportation, the Paris Climate Agreement, and progressive tax policy. Trump is aggressively attacking all of these things - particularly with MAGAs “One Big Beautiful Bill” (OBBB) now heading to Trump’s desk. As you’ve likely heard, this bill does a plethora of terrible things, but what I’ll be focusing on today is debunking Trump’s false claim that wind and solar are somehow bad.

I’ve spent the last 10 months learning from one of the best energy economists in the world, and I’ve been writing papers on electricity markets, transmission lines, grid-scale batteries, climate policies, and more. Over the coming weeks and months, I plan to share some blog-ready versions of the papers I’ve written on my own and with my colleagues.

This post will serve as a foundation for electricity economics and a reference for later as I dive deeper into the intricacies of energy policy. More importantly, I hope to show you why the Trump administration and their MAGA followers are so desperately wrong about renewable energy. Renewables reduce your electricity bill dramatically and reduce greenhouse gases, and I’m going to explain how in this post. So, without further adieu, let’s get into it.

The Economics of Electricity Markets

As it turns out, electricity markets offer a great setting to study economics. Not only is there a ton of data available, due to the data-heavy nature of the industry, but electricity markets work in a way that clearly illustrates supply and demand. I’ll start by explaining how electricity markets operate from country to country; then I’ll illustrate the economics; and, finally, I’ll explain the challenges we face next and the inevitable success of renewable energy.

How do electricity markets work?

Electricity is a homogenous good. In other words, electricity cannot be differentiated by source or producer. Electricity is just electrons flowing from a generation source to consumers:

Since there’s no such thing as “better” or “worse” electricity, all we really care about as consumers is the price. Socially and environmentally, we may care about how our electricity is made - preferring renewable and clean sources - but knowing the source of your power doesn’t really change how anyone consumes electricity. In fact, electricity consumption doesn’t change much as prices change either - making electricity one of the more inelastic goods we consume day to day.

Electricity markets are a classic example of a natural monopoly. This just means that it’s more economical for one entity to supply energy to your home than it is for multiple companies to compete for your business. For more than one company to compete for transmission, they would each need their own grid throughout the region - effectively doubling the fixed costs for electricity delivery on a regional economy - which would be a silly way to operate an electricity market.

Instead, we’ve found that it’s cheaper to share the costs of building and maintaining a single grid, but we still need to think about the market power that monopolies carry if left unchecked. Monopolies in any industry have great market power - i.e., monopolies have the ability to manipulate prices by manipulating supply, demand, or both. And because price elasticity of demand for electricity is inelastic, this would make it easy for electric utilities to take advantage of consumers by increasing prices and earning unreasonable profits. To protect consumers from this, governments regulate their electric utilities (and other utilities) on a spectrum between two main categories: liberalized markets and regulated monopolies.

Liberalized vs. regulated electricity markets

No two electricity markets operate in the same way, but there are two general camps that they reside in: Liberalized and Regulated Monopolies.

Liberalized markets open up regional generation to a competitive bidding process while the transmission and distribution of electricity operate as a monopoly. This is how grids operate in Europe, Texas, California, and much of the developed world. For example, California’s Independent System Operator (CAISO) auctions generation rights to private companies that generate electricity via renewables, gas, etc., and the cheapest fuels are obviously bought first - because electricity is a homogenous good.

Regulated monopolies operate on the other end of the spectrum. They own everything from the generation plants to the transmission and retail distribution. These grids can be either government-owned or privately-owned, but will be heavily regulated by price or revenue. There aren’t many grids that operate on this extreme of a monopoly level anymore - many grids are a hybrid between liberalized and regulated monopoly, including New Mexico’s Public Service Company (PNM).

PNM is privately-owned, regulated by the New Mexico Public Regulation Commission (PRC), and is vertically-integrated (PNM owns much of it’s own generation), but they also purchase electricity wholesale through long-term contracts with private generators and from other markets, including now CAISO. Connecting regional markets enhances reliability and reduces price spikes for all parties.

Here’s a map of the liberalized (Wholesale) electricity grids in the US, with the grey areas being regulated monopolies or hybrid markets:

Now, for the rest of this post were going to focus on liberalized markets because they offer the cleanest insight into the economics of energy and the efficiency of a competitive market. In reality, regulated monopolies, hybrid markets, and fully liberated markets operate under the same economics if regulated properly, but that depends on the case. I may write more about the trade-offs between liberalized and regulated markets in a future post, but today I’d like to focus on the intuition of the economics.

So, let’s talk supply and demand.

A matching game

Electricity markets are a modern miracle if you think about it. The grid operator has the difficult task of matching supply and demand every hour of the day, 365 days a year. If they supply too much or too little to the grid, the equilibrium is broken and we experience a blackout. In liberalized markets, the matching game is supported through a competitive bidding process. Generators submit bids in electricity markets - including long-term contracts, day-ahead bidding markets, and real-time (or intraday) markets - to meet anticipated demand.

The grid operator carefully matches supply and demand in every hour as every hour comes with different demand, renewable generation capacity, etc. - making each hour of the year is it’s own “market” with unique supply and demand equilibriums. Some markets even operate on 30- or 15-minute frequency.

Electricity generators compete in each of these markets - bidding prices that will cover their costs of operating while undercutting their competitors - earning themselves the right to participate in the market. If they earn a spot in the line-up, they generate the quantity of electricity they committed to in the auction, and in return they receive as payment the highest bid selected in the auction, not the price they bid. This is an important distinction: electricity generators receive as payment the highest accepted bid in that market - not the price that they bid.

How do generators know how much to bid?

As private actors in the economy, generators need to earn back the money they invested into the project over time plus a profit. I.E., they need to earn back the fixed costs (the cost of building the generation technology, acquiring the land, etc.), marginal costs (the costs of operating the technology for a given MW of generation), plus a profit incentive.

In a competitive market, economic theory shows us that wholesalers will bid a price per MW that is equal to their marginal costs because they will often earn more than their marginal costs in return. Remember, if another (more expensive) technology is selected after them in the auction, in return they earn back more than their marginal costs - which goes toward paying back their fixed costs over time. This is the beauty of a competitive wholesale electricity market - in theory, consumers get the lowest prices possible for the quantity of electricity they are demanding, and the market can efficiently cover costs and invest in cheaper generation.

Let’s graph the supply and demand to illustrate.

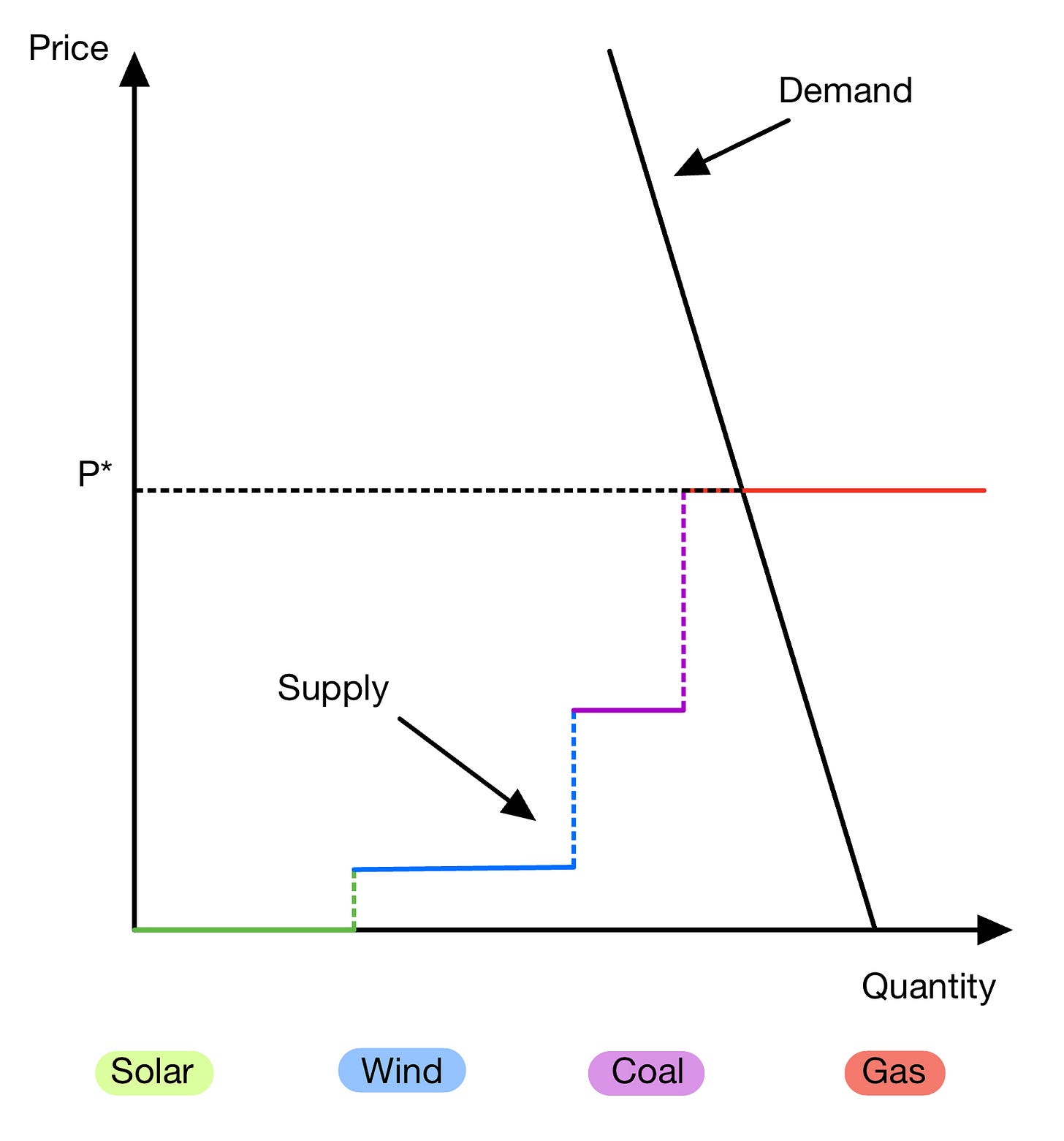

As noted, the marginal costs of each technology in the generation mix available become the bidding prices and make up the supply curve below (the colorful stepped line). The demand curve (the near vertical black line slanting downward) is the price consumers are willing to pay per MW of electricity. The near vertical slant of the demand curve illustrates the inelastic nature of electricity. Wherever the supply and demand curves cross each other, we end up with the price of electricity consumers see on their bill (P*).

Of course many consumers opt into stable prices, or other pricing schemes, but P* is likely the price consumers pay on average. You can plainly see how the most expensive generation type by marginal cost sets the price of your electricity. While this graph is simplified, it is true that solar, wind, hydro, and other clean technologies have marginal costs at or near zero thanks to their automatic nature - once the generation plant is built, the electricity is basically free.

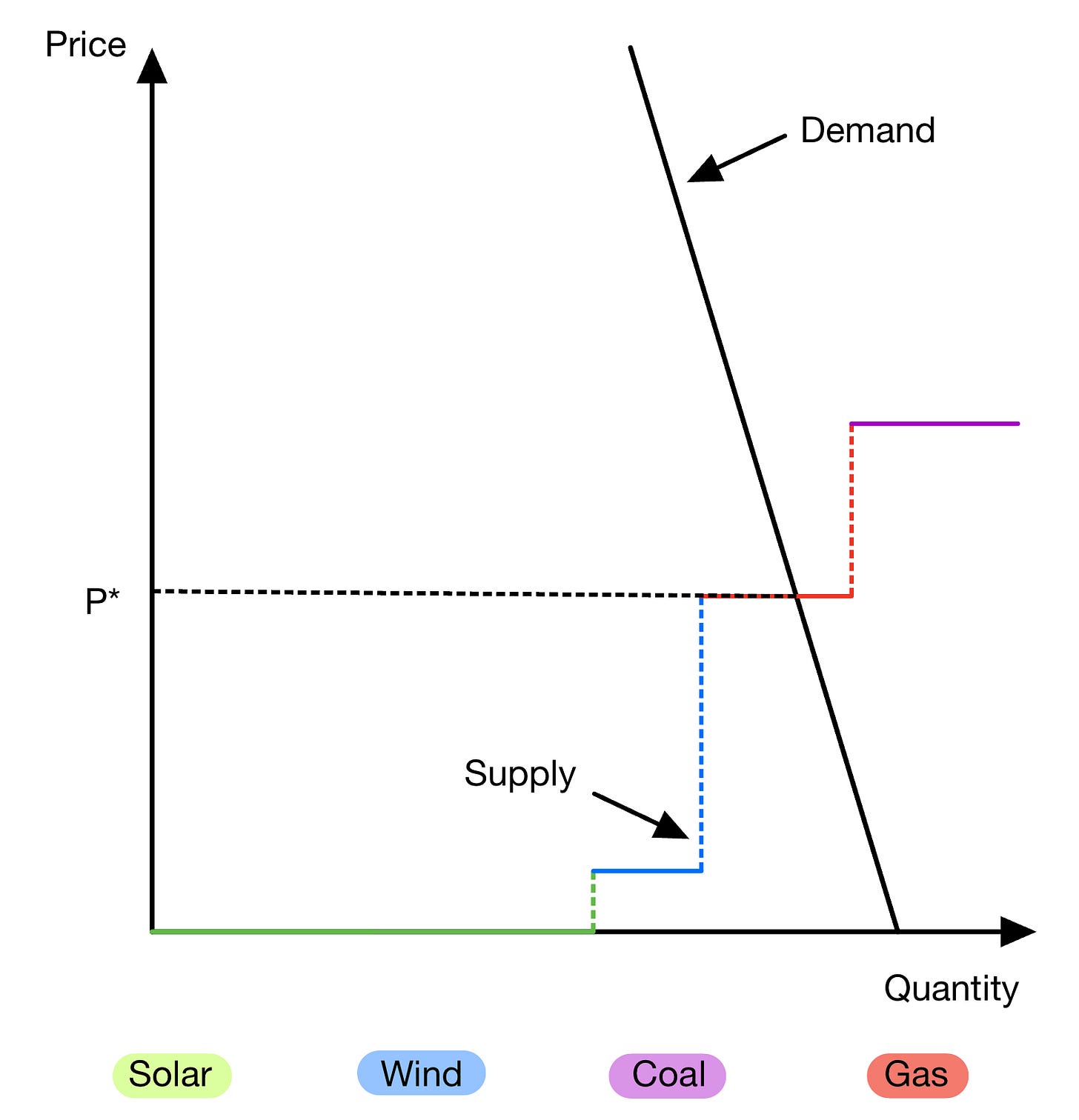

Gas and coal plants have fuel and other operating costs that are priced into their bids (marginal costs), making them more expensive, and often making them the “price-setting” technology on the supply curve. Let’s see what happens when we double the amount of solar for this given market.

Here you can see that if demand stays the same, gas is no longer “in the money,” and therefore the price of electricity goes down for consumers. This is exactly how adding more renewables to the grid lowers the price of electricity. It’s not hard to imagine how a grid that is completely supplied by renewables could supply almost free electricity to consumers. In markets with high amounts of renewables, like in South Australia, there are many hours of the day in which electricity is free.

Emissions from electricity generation generally come from the most expensive sources - which provides all the more reason to get rid of them. Coal is by far the dirtiest fuel on the market despite being cheaper than gas, but this could be easily fixed with a carbon tax. In markets with a carbon tax, like California or the UK, coal will generally be further up the supply curve:

The carbon tax internalizes the climate externality, it often causes coal to be “out of the money”, and it further increases the profits of renewable generators and further incentivizes private investment in renewables.

These graphs show how profitable it is to be a renewable energy producer today, with or without a carbon tax, as they are earning everything between their marginal cost (colorful line) and P* as profit. This is driving unprecedented investments in renewable energy as investors aim to undercut the incumbent dirty fuels - driving out the dirty fuels and resulting in a cleaner grid over time.

Intermittency and rising demand

So far, this all sounds great, but what happens when the sun isn’t shining and the wind isn’t blowing? It’s true that renewables can’t always be online by their very nature, but it’s not the problem Trump believes it is. He often claims renewables are unreliable and increase electricity costs, but his narrow vision has fooled him and his followers. As we’ve discussed, renewables often don’t set the electricity price - gas and coal do. So whether the wind is blowing and the sun is shining or not, we can only blame the least efficient generators: coal and gas.

Furthermore, technologies like grid-scale batteries and long-distance transmission lines (interconnectors) are becoming cheaper and more efficient - further increasing renewable generator’s ability to provide cheap, clean energy. Batteries and interconnectors will be our tools to fight intermittency as investors build them to move energy through space and time to undercut the price-setting technology. The UK has found great success using these tools to achieve their climate goals and lower electricity prices in the face of intermittency - this is the subject of my thesis which I’ll write about very soon.

As the economy demands more EV’s, electrified appliances, and AI, the strain is going to challenge our current grid. Renewables, batteries, and upgraded grid technologies (like interconnectors) are needed to satisfy this increasing demand. Our simple supply and demand model above shows us that when we decrease renewables and increase demand, we get higher prices and give more market power to coal and gas generators, allowing them to increase prices.

The Implications of MAGA’s OBBB

Trumps bill is horrible for your electricity prices, the environment, and US geopolitical dominance:

Prices: Republicans are killing IRA clean energy incentives for wind, solar, and batteries, and actually increasing taxes on these technologies. This will result in less (but not zero) investment in these technologies over time - affecting the bidding prices for wholesale electricity generation and the price you ultimately pay month-to-month for energy.

Environment: By slowing down clean energy investments, we are extending the possibility of us reaching net-zero further into the future. This will obviously lead to more warming, more climate damages, and a more expensive task for future generations.

Geopolitical security: China is subsidizing and building unprecedented amounts of clean energy, and is now set to dominate the clean energy race as the IRA is decapitated. This will affect our ability to affordably leverage AI and expand the manufacturing economy Trump claims to care about.

In summary, Trump and the Republicans are just plain wrong about renewable energy, and we will be set backwards because of it. It’s unclear whether they are ignorant to the economics or bought-out by oil and gas, but both storylines are troubling.

To me, there is a silver lining in all of this: its the fact that Trump’s goal of killing renewable energy will never win in the end. Even though Trump is attempting to change the playing field in favor of dirtier, more expensive fuels, the economic case for clean energy is simply too strong. Trump is doing everything he can to pander to his rich oil and gas executive friends, but the economics are luckily not on his side.

Very informative!