Will We Ever Have a Recession Proof Economy?

Economics is naturally a very difficult field of study in the social sciences world. Not only does an economist have to understand the financial landscapes of mathematics, statistics, and quantitative analysis, but they also need to (attempt to) understand the human behaviors that drive the economy, the political influences that steer our beliefs, and our earth which can bring natural disasters at any moment. A terrorist attack, a coronavirus, or a failing mega-bank could cripple our economy to its knees.

In short, no, we may not ever have a recession proof economy. Economists have to worry about too many aspects for them to be so sure that they are predicting correctly. This creates a network of economists that are scared of being wrong and little incentive for them to put their necks on the line. While top level financial executives get millions of dollars per year in salary, economists are not compensated nearly as well. What type of career would you expect top talent to be drawn to? Thats right, not economics.

Funding isn’t the only issue, of course. There have been many talented economists come and go, and now isn’t any exception. Although, even with all of the Harvard and Yale Phds working at central banks around the world, I am not optimistic about our ability to have a recession-proof economy at any point in the near future.

The aspect of economic modeling that I can understand the most is that of the financial markets. Financial analysts at big banks will attempt to forecast different aspects of the market by using a series of assumption like: inflation staying at 2%, or interest rates continuing in a certain direction. With so many guessed assumptions in a forecast, it is incredibly hard to pick a winning stock, a price bubble, etc. even though thousands of ‘day-trading gurus’ online will try to convince you that they have figured out how to turn a consistent profit that outpaces the overall market.

In fact, you will be hard-pressed to find any fund manager who can outpace the S&P 500 on a consistent basis. Warren Buffet of course being an exception as he has averaged about 20% every year his entire career. Buffet is not like the gurus online though, he’s actually quite the opposite. He understands how incredibly difficult it is to predict the market so he employs value investing as an investing philosophy. You can read more about that here. In summary, value investing is about finding financially strong companies with good management, expected industry growth, etc.

My point is this: not even Warren Buffet and his team of analysts at Berkshire Hathaway would be able to predict our next recession. He knows that the more you try to understand and beat the market, the more you are likely to lose. A diversified, passive, investment philosophy is what most financial advisors will prescribe. So why not add some diversity to our economy? We’ll get back to that.

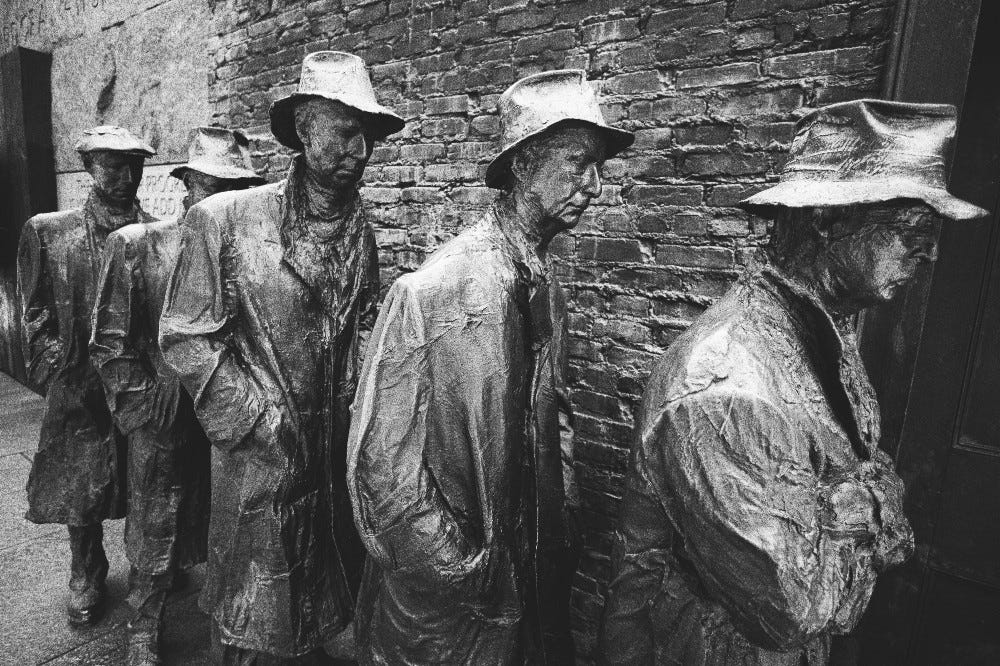

For now, let’s talk regulation of the financial markets. We know that the market is wildly unpredictable because humans are emotional beings. We also have an endless amount of information being thrown at us that steer their financial decisions. We want the next gadget, the new car, a bigger house, and a get-rich-quick portfolio. This sentiment makes our financial decisions less than ideal. Before the recession of 2008, millions of Americans were buying homes that they couldn’t afford and the loaning banks were letting them! At the time, the borrowers were getting the house they thought they wanted, the banks were getting the loans they thought they wanted, and real estate agents were getting all the commissions they could handle. The aftermath is all too well-known.

Now, there are more regulations that are supposed to keep individuals from buying homes outside of their means. Still, the system isn’t perfect. We may never be able to keep people from making poor financial decisions and we may never keep banks from making risky decisions in one capacity or another. At the center of a financial crises, like in 2008, there are individuals making poor financial decisions and our Congress is mostly reactionary in regulating destructive financial phenomenon.

Besides, Congress has their hands in the pockets of those making the risky financial decisions and are not as ‘long-term-goal’ oriented as I would like them to be.

With this, we can deduct that harnessing the knowledge of the financial experts isn’t going to be enough to help economists predict or prevent a recession. With that in mind, how else can we predict/prevent recessions?

Well, there are many moving parts. The sad fact of it all is that if a recession proof economy is possible, we will have to learn how to achieve that the hard way. New industries arise every year, with their respective risks, adding another spoke to the wheel of our economy. If we don’t recognize the risk in time, then it could result in a recession. Then, of course, the government reacts in to it in hopes to do better with that industry in the future. Like I said, Congress tends to be reactionary. Will blockchain technology make traditional banking obsolete? How about AI and automation? And most importantly, will we see the changes happening in time to do something about the risks that come with them?

I don’t have the answers to that and I wouldn’t trust anyone that claims to know. I believe that with every new innovation, the economists job will get a little harder but they will get better as well. Computer technology is helping our econometrics become more complete. Cross-disciplined economists are coming up with new ways to solve problems. Though, in the end, I think that if a recession proof economy is possible, it would be a far more democratic system than we have right now.

Think about it. The wealthiest top 1% own 51% of the stocks while the bottom 50% owns less than 1%. Monetary policy directly affects the price of stocks. The same monetary policy would positively affect more than just the top 1% if the bottom 50% had a slice of the pie. Central banks could positively affect the trajectory of an economy from the ground up.

To conclude, let’s get back to the topic of diversification. You wouldn’t want to put all of your retirement fund into two or three stocks in hopes that they will make your money grow. So why are we allowing that to happen with our countries wealth?

Remember how the top 1% owns more than half the stock market? Right now, the market is being controlled by too few people. If those few people make a couple bad decisions, we could have another financial disaster on our hands. We need to diversify our financial decisions by giving more financial decision making power to the middle and lower classes. Capitalist societies vote with their money, and right now, most of our citizens don’t even have a ballot to vote with. What a democracy!

We learned hundreds of years ago that a market left to its own devises will result in a recession, therefor, we can’t have a libertarian view on the markets. On the other hand, we are aware of the positives that a free market brings in terms of innovation and wealth, so maybe we shouldn’t aim to be 100% communist. The sweet spot lies somewhere in the middle but it’s hard to tell exactly where.

We should not be scared of regulating more aspects of our economy in order to avoid issues that are almost certain to arise if left to their own devices. One aspect of that is wages. There is no reason a CEO should make 300 times the wages of their subordinates. I don’t care how smart or important you think you are, your employees are key components of your organization and should be compensated fairly. Workers cooperatives have the ingredients that I think can help our economy perform in a more democratic and equal way that is necessary in a recession resistant economy.

In summary, recessions are ingrained into the framework of our economy and it will take some change if we want to ease the strain that inequality puts on us. The economy is a network of people, currencies, natural habitats, commodities, governments, and so much more. While we may never be able to achieve ‘recession proof’, we can certainly get closer with what we already know.

If you have anything to add about my discussion here today, or have an idea you would like me to write about, please reach out to me in the comments below or on my LinkedIn.