New Mexico's grid hits 59% renewables without raising electricity prices

Since 2001, New Mexico’s renewable buildout has accelerated faster than most states - without driving up electricity costs.

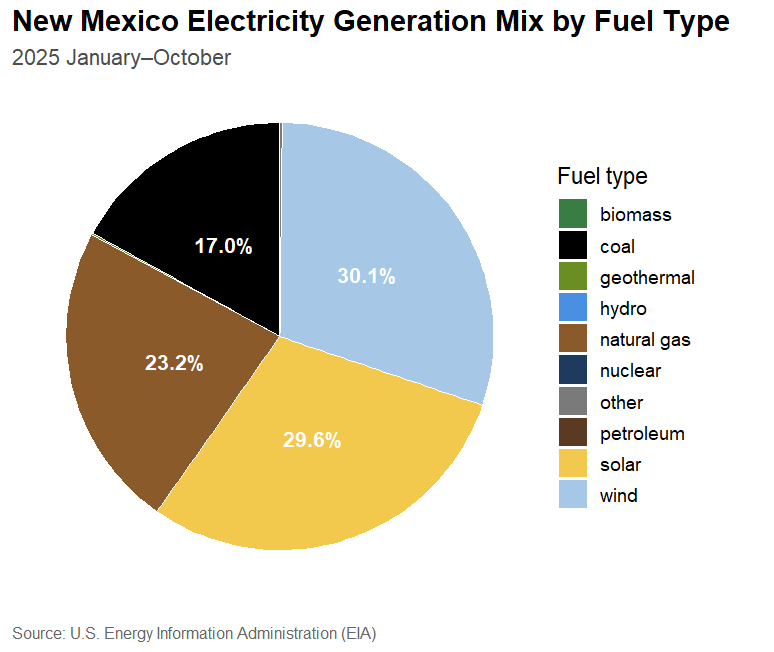

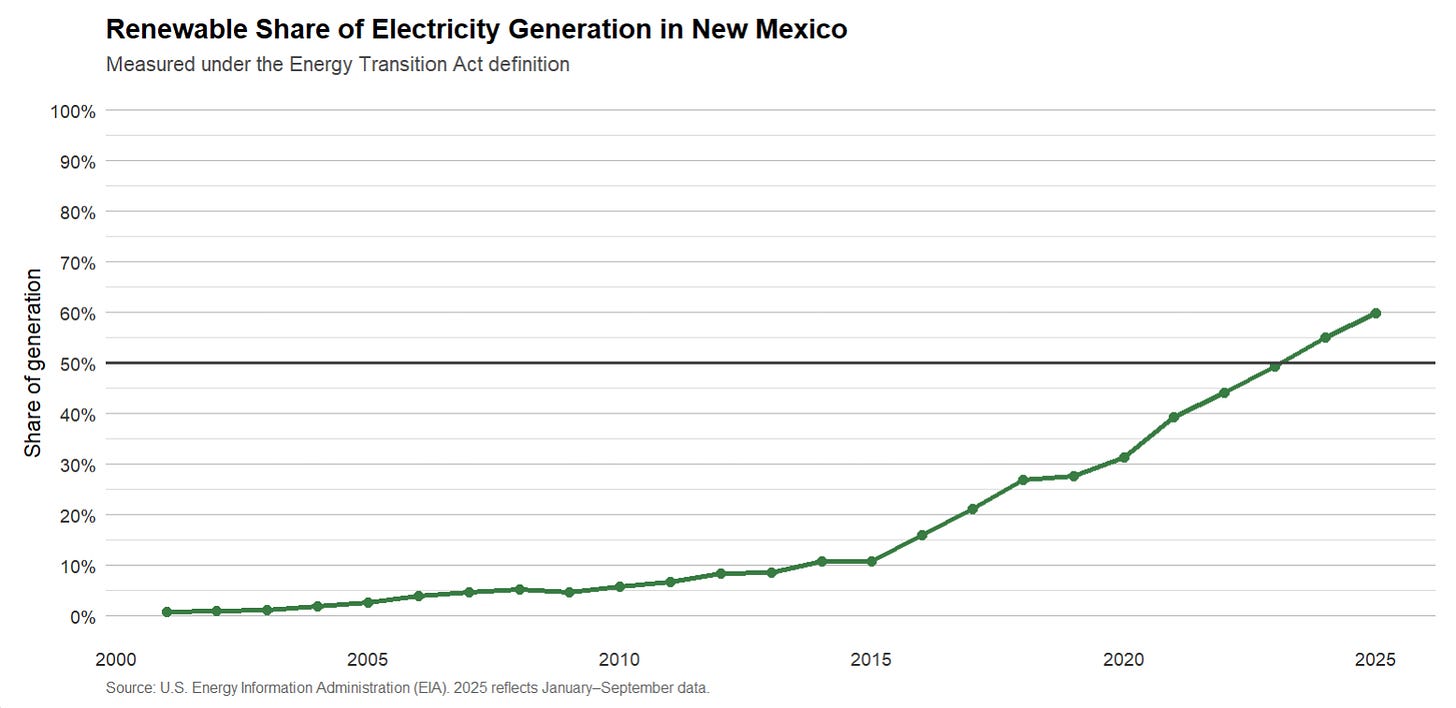

In 2001, New Mexico had with one of the dirtiest electricity grids in the US, with just 0.8% of generation coming from renewables. It ranked as the 7th-dirtiest grid by percentage, dominated by coal. Fast forward to today, New Mexico has the 9th-cleanest grid with 59% renewable generation through the first 10 months of 2025. Since 2001, only Vermont has increased renewable generation share more than New Mexico.

A blend of political will, market development, and natural resources across the Southwest helped make this happen. The Energy Transition Act (ETA) accelerated renewable development, while a pro-build stance on transmission helped New Mexico leapfrog many of its peers.

Not only is New Mexico ahead of its interim ETA goal of 50% renewables by 2025, but prices haven’t risen like critics warned. In fact, New Mexico has some of the cheapest electricity in the nation.

My last post explored New Mexico’s oil and gas dominance. This post shows that New Mexico is a clean-energy powerhouse too.

The Energy State

New Mexico ranks third among states in total share of US energy production. For a relatively small state of 2 million people, vast land and natural resources allow New Mexico to punch above its weight. With the most productive oil and gas field in the world, two of the largest wind farms in the US, high solar irradiance, geothermal resources, and a strong energy R&D community, New Mexico is a top energy state.

At the same time, state leadership has been willing and eager to advance the energy transition. While oil and gas remains the dominant industry, New Mexico is making moves to be ready for the electrification of the economy. The future of economic development starts with having a grid that can support data centers, electric cars, advanced manufacturing, and more. And, of course, it’d be nice not to ruin the climate while we grow. The Energy Transition Act (ETA) is New Mexico’s bid to achieve that future.

The Energy Transition Act

The ETA was passed through the legislature and signed by Governor Michelle Lujan-Grisham in 2019. It’s a clean energy standard (CES) which requires electric utilities to reach 100% zero carbon by 2045, and rural electric coops by 2050, with interim goals of 40% by 2025, and 50% by 2030.

New Mexico, in aggregate, has already met and surpassed its 2025 goal as the state generated nearly 60% of its electricity from renewable resources during the first 10 months of 2025.

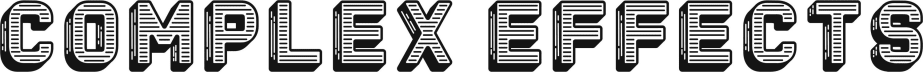

The dominant source of energy in 2025 (through October) was wind at 30.1%, with solar and gas coming in close behind. The coal industry is still quite relevant, but was probably less relevant in November and December as air conditioners turned off, but we don’t have that data yet.

Over time, the renewable generation share keeps growing and doesn’t look like it’s going to stop.

Since 2016, the year the US signed the Paris Agreement, New Mexico’s renewable generation share has increased rapidly, with an average annual percentage growth near 20%. New wind and solar kept getting cheaper, allowing utilities to retire aging coal plants. In 2017, when the San Juan Generating Station started closing, few federal and state programs were around to support coal workers specifically, leading to job loss and unemployment into the 2020s. In 2019, Lujan-Grisham signed the ETA - establishing the Displaced Worker Assistance Fund, retraining programs, and other support specifically for New Mexico coal workers. It’s better than nothing, but many say this was too little too late.

Nonetheless, the ETA all but ensured the renewable future that was already taking shape. The fastest growing fuel type lately has been solar, which saw 248% growth over the last 5 years. Next is wind, which was the largest energy source in 2025 through the third quarter and has grown by nearly 90% over the last five years.

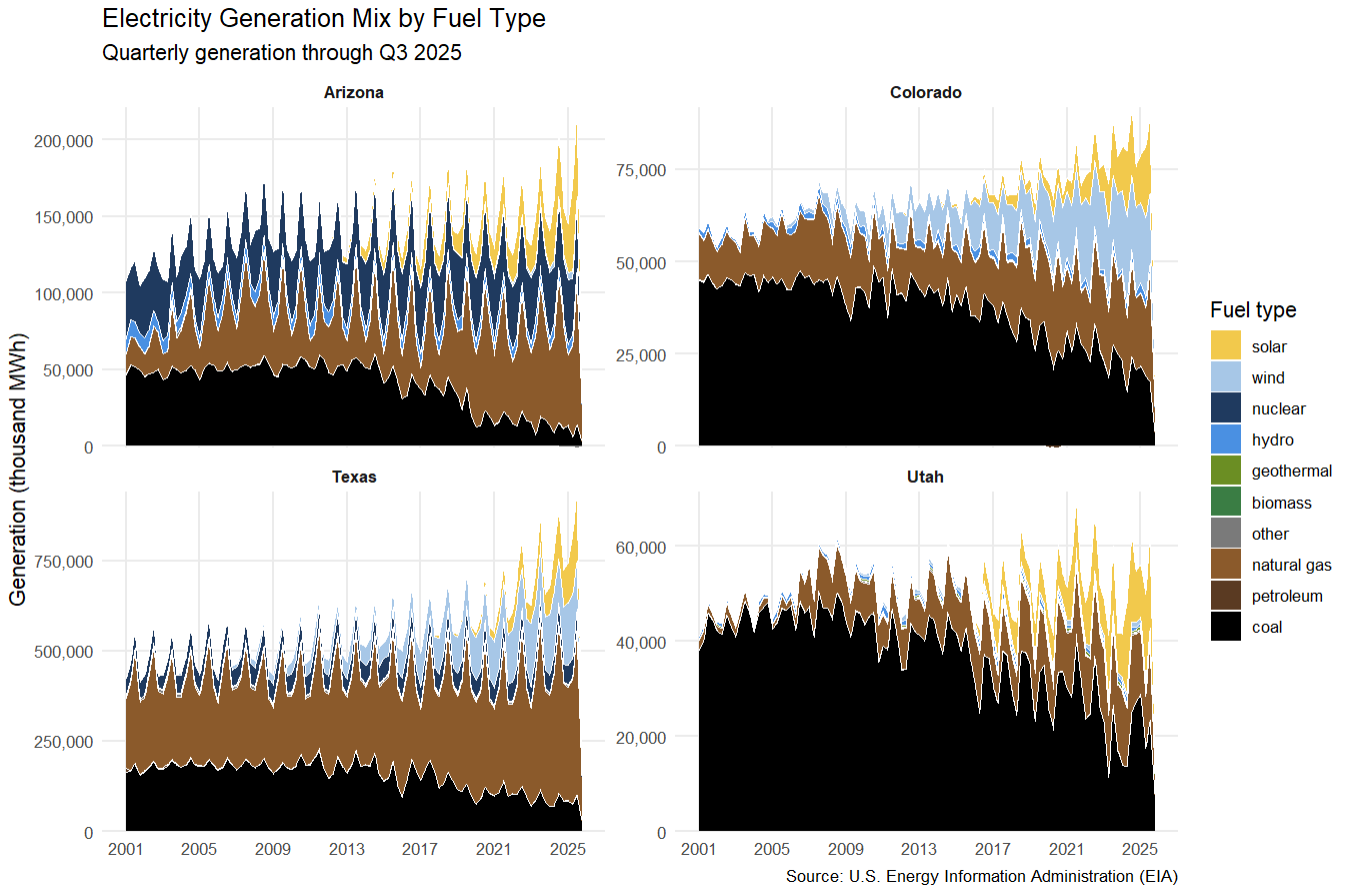

Comparing New Mexico’s grid to it’s neighbors, which have very similar geography and natural resource potential, reveal how policy and labor force has shaped each of their generation mixes.

The charts below give hints about how things work in different states. Arizona had the political will to build nuclear back in the 1970s, and still utilizes it. Colorado has a generation mix quite similar to New Mexico. Texas, unsurprisingly, uses a ton of their own natural gas. And Utah has a legacy coal industry that’s slowly giving way to more renewables.

One thing that’s common between New Mexico and its neighbors is the growth in solar over the last five years. The EIA thinks that trend will continue:

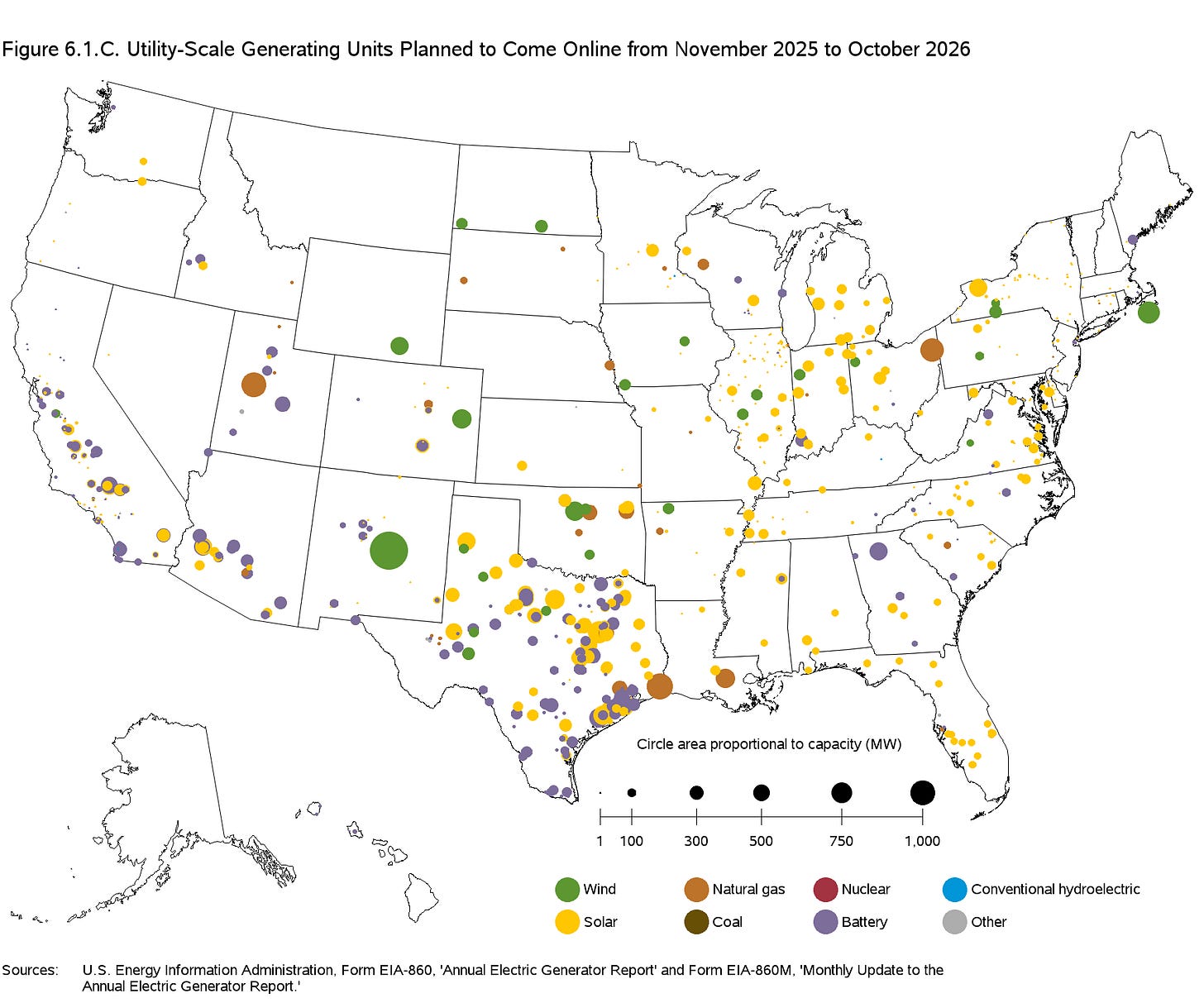

Increasing electricity demand is being met by higher generation from most energy sources in 2025. We expect that utility-scale solar will grow the most, generating 33%, or 72 billion kilowatthours (BkWh)... New solar projects account for more than half of the new generating capacity expected to come online this year.

Wind generation is also expected to grow - with the largest projects in the nation coming online in New Mexico this year.

According to this chart, New Mexico is also building a few more grid-scale batteries. Some of these may be PNM’s, as they plan to add 593 MW of battery storage by 2028, and approach 2 GWs of storage by 2040. That’s roughly half the size of New Mexico’s current total generation capacity today.

Utility performance in New Mexico

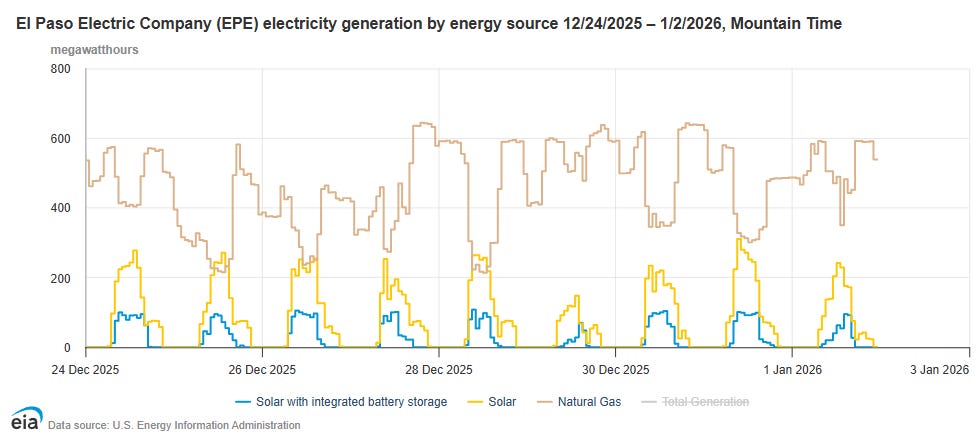

Within New Mexico, we see that the three big utilities have varying levels of renewable capacity. PNM has taken on the lions share of the decarbonization efforts in New Mexico with more than 70% of their own electricity being carbon free. Southwestern Public Service Company (SPS) is projected to exceed the 2025 ETA goal as well, but it may be close for El Paso Electric (EPE), who failed to meet the standard from 2020 to 2023.

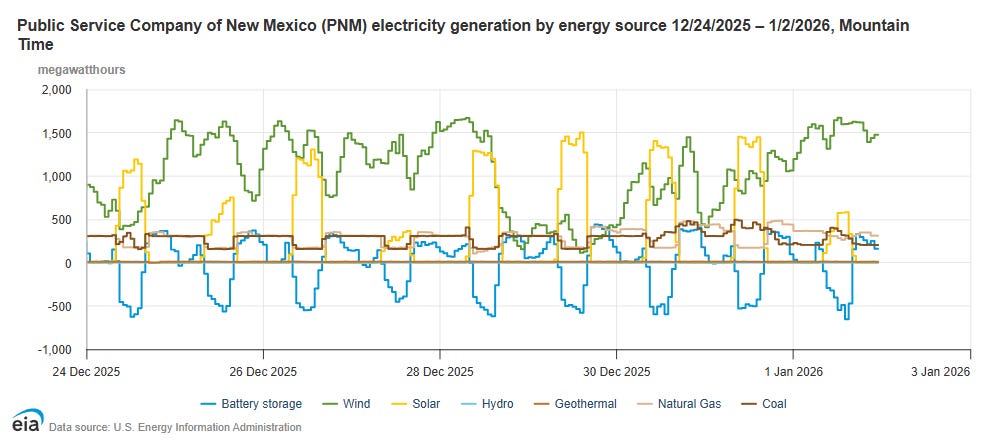

While servicing two-thirds of the state’s population, PNM meets demand with large amounts of wind, solar, and batteries. PNM’s ‘Real Time Renewable Energy %’ said that 95% of PNM’s generation mix was renewable on the afternoon of New Years Eve.

The graph below shows PNM’s fluctuations over nine days in generation types, and battery charging and discharging. The afternoon of NYE, the wind wasn’t even at peak capacity.

While PNM’s solar and wind generation outpace gas and coal, EPE, servicing the Las Cruces area, is still dominated by natural gas. Large solar plants are being planned, though.

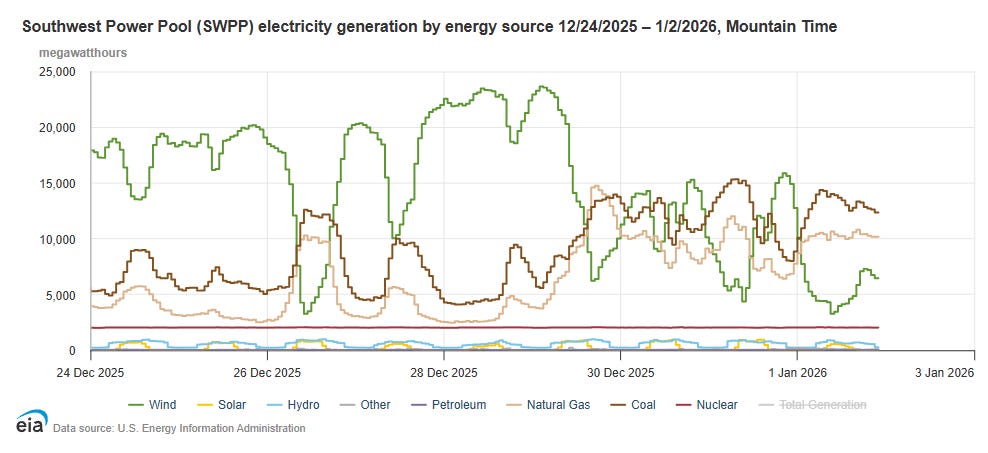

And SPS, which services the eastern edge of the state, has large wind assets in the area and an integrated transmission system integrated with Southwest Power Pool Markets+.

These graphs show where the state has room for improvement. Windless days can be fought with more batteries and inter-state trade, helping decarbonize and fight high prices.

Prices

Many still claim that renewables make electricity more expensive, but it’s not true. In a study on Chilean renewable expansion, Gonzalez et al., “find that market integration resulted in… increases in renewable generation, and decreases in… cost and pollution...”

My own back of the envelope regression shows that generation mix alone only accounts for ~3.5% of variation in prices in the US. Using monthly data across all U.S. states, I examined whether cleaner electricity generation actually drives up power prices. After controlling for state-specific factors and national trends, my analysis finds that greater reliance on wind and hydropower is associated with lower prices, and changes in the fuel mix explain just a few percent of price variation.

In other words, the evidence does not support the claim that renewables are a primary cause of higher electricity prices. Instead, prices are more influenced by a dynamic mix of geography, wholesale trade, weather, natural resource abundance, and other factors influencing supply and demand.

New Mexico’s abundance of energy, renewable or not, and relatively low demand has translated into the cheapest industrial-use electricity in the US, with 5.53 cents/kWh as of October 2025. Across all sectors (residential, industrial, commercial, and transportation), New Mexico has the second cheapest electricity in the nation - second only to North Dakota.

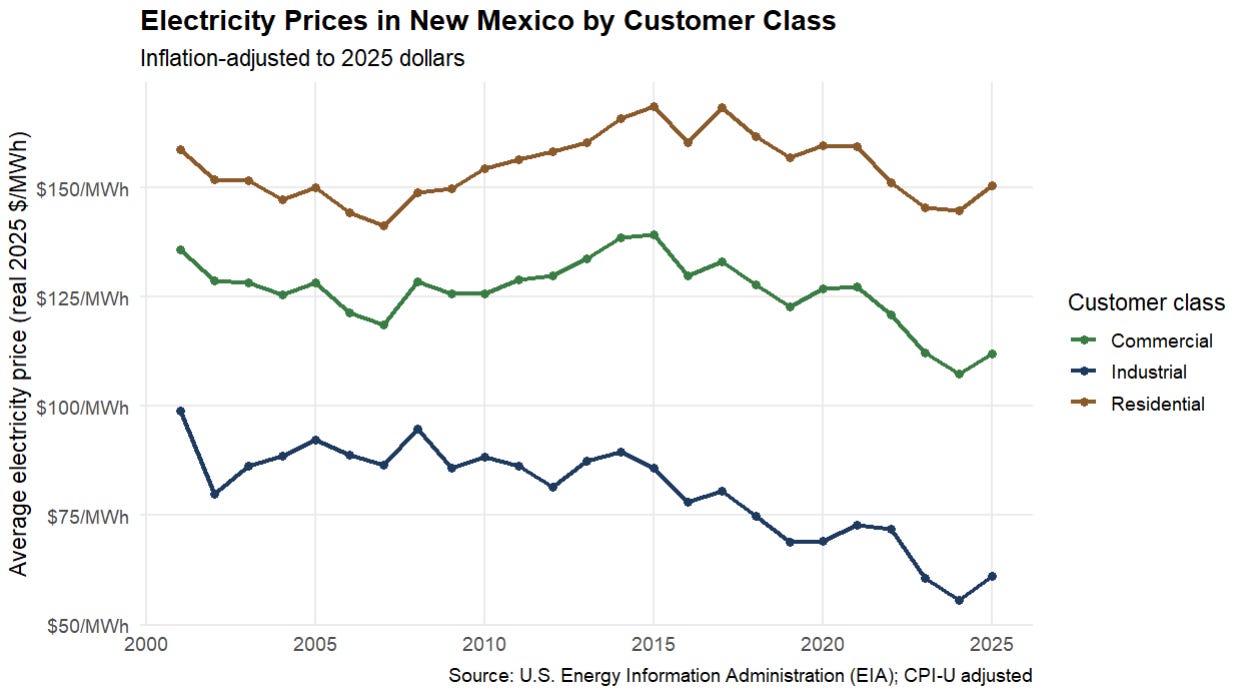

If renewables did somehow increase electricity prices, you’d see it in this inflation-adjusted graph of electricity prices over time in the state. Commercial, industrial, and residential customers face different electricity prices because they purchase power under different wholesale and retail arrangements, and they have all either stayed the same or gone down since 2001.

The future of New Mexico’s electric grid

PNM joined the Western Energy Imbalance Market (WEIM) in 2021, a real-time market that dispatches energy every 5 minutes. PNM has also committed to joining CAISO’s Extended Day-Ahead Market (EDAM) in 2027, helping balance short-term supply. EPE surprised many when it committed to join Southwest Power Pool’s Markets+, another day-ahead market headquartered in Arkansas. Customers of the big three utilities, and many small cooperatives and municipal-run utilities, will benefit from more competitive trade in the region.

The proposed Blackstone acquisition of TXNM Energy, PNM’s parent company, would not likely keep PNM from joining markets. However, a Colorado-style electricity market requirement would ensure market participation and add downward pressure on prices.

TXNM, PNM, and Blackstone announced the proposed acquisition earlier this year. This news has been met with frustration by rate payers as they fear the firm will increase their rates. Many op-ed’s have been published questioning the conceivably dodgy motives of Blackstone, but nobody has publicly questioned why TXNM wants to be acquired in the first place.

Today’s post isn’t about Blackstone, but (maybe the next one will be).

Today’s post is about giving the state it’s flowers because some of these accomplishments have gone unnoticed. There’s a lot more to do, like maneuver a private equity take-over, but there’s plenty to be proud of. 25 years ago, renewable energy wasn’t taken seriously. Today, it powers nearly 60% of New Mexico and prices are nation-leading anyways. The oil and gas industry may have made NM an energy state, but New Mexico will be an energy state long after oil and gas.

You have to be careful in making assumptions using generation data from EIA. PNM and EPE have contracts to sell a good deal of nuclear energy generated in Arizona. PNM said they got 24% of the energy from nuclear in 2024. And 3 TW or more of wind energy generated in NM is under contract to be sold to consumers in other states like AZ and CA. And roughly 80% of the coal power generated in Fruitland NM (the only operating coal plant in the state) is exported to AZ.

NM is indeed a powerhouse of energy generation. We are also a huge exporter of energy. The ETA drives the energy we use within the state, not exports. Because of this the ETA-qualified percentage of renewables may be lower than 59% if you account for imports and exports. Regardless, NM is a national leader in clean energy and PNM is clearly ahead of the requirements of the ETA. We should absolutely celebrate where we are and where we are going!

Also be careful using utility rates from national databases. There are significant errors there.

And if coal is a "base load" generation resource (meaning that it runs all the time) then why would it be less relevant when air conditioners run less? Gas is the flexible power source so I think we'd use less gas in proportion, and hence more coal in proportion, when overall consumption decreases. This goes for nuclear as well.

The case study here challenges a lot of conventional wisdom about renewable transitions and costs. What stands out is how the Energy Transition Act combined policy certainty with existing natural resource advantages, basically making New Mexico's grid economics work in favor of renewables rather than against them. I've seen similar dynamics play out in smaller municipal grids where cheap wind contracts actualy lowered rates while coal retirements were happening anyway. The real lesson mightbe less about renewables specifically and more about timing transitions correctly with market forces.